No products in the cart.

Colorado Energy Office Partners with Everblue to Expand Access to Weatherization Training

Colorado Energy Office has partnered with Everblue, a leader in workforce development and energy efficiency training, to offer 9 months of access to its online course catalog for contractors participating in the Weatherization Assistance Program (WAP) across Colorado. This initiative will provide convenient, on-demand training to empower contractors with the skills and knowledge they need to deliver energy-saving services to homes statewide.

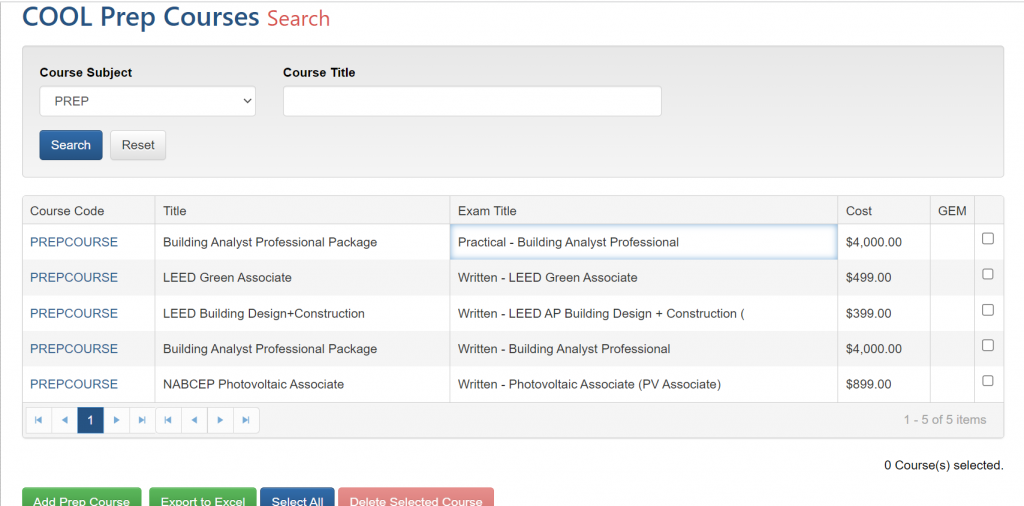

With a simple one-click registration on the Everblue website, WAP contractors will gain immediate access to over 10 courses, including industry-recognized certifications like BPI Building Science Principles, BPI Building Analyst Technician, BPI Building Analyst Professional, NATE, OSHA 10/30 Construction Safety, and Retrofit Installer Technician / Crew Leader. This course selection represents a strong foundation for those new to the weatherization industry, as well as essential upskilling for experienced contractors.

Making Training Accessible Anytime, Anywhere

Everblue’s secure online learning portal allows participants to learn on their own time, with 24/7 access to pre-recorded video modules. This means that contractors across the state no longer need to travel to attend training sessions. The flexibility of online learning ensures contractors can fit their professional development around their existing schedules while maintaining high-quality energy efficiency services.

Certification exam fees are separate from the course offerings, but Everblue has made the testing process as seamless as possible. Several exams can be taken remotely, and for those that require in-person proctoring, Everblue will organize test sessions in strategic locations throughout Colorado.

“This partnership is a game-changer for Colorado’s WAP contractors,” said Velvet Nelson, Everblue WAP Program Manager. “By offering access to our online catalog, we’re not only improving participation rates but also ensuring contractors have the critical knowledge they need to succeed. This accessibility will help ensure that everyone, regardless of location or schedule, can stay up-to-date with industry best practices.”

“I’m excited to see how this partnership with Everblue will elevate the standards across the entire Colorado WAP network,” said Jacob Wolff, Quality Assurance Manager at the Colorado Energy Office. “The convenience of on-demand learning combined with the breadth of courses will make it easier for contractors to gain expertise in areas critical to their work. Everblue has made the whole process incredibly user-friendly, and I’m confident this will lead to improved, consistent performance across the board.”

For more information about Everblue’s partnership with the Colorado Energy Office and how to enroll in these courses, please contact Velvet Nelson at [email protected].