No products in the cart.

Everblue’s Related Technical Instruction for Apprenticeships

Related Technical Instruction (RTI) for Your Apprenticeship Program

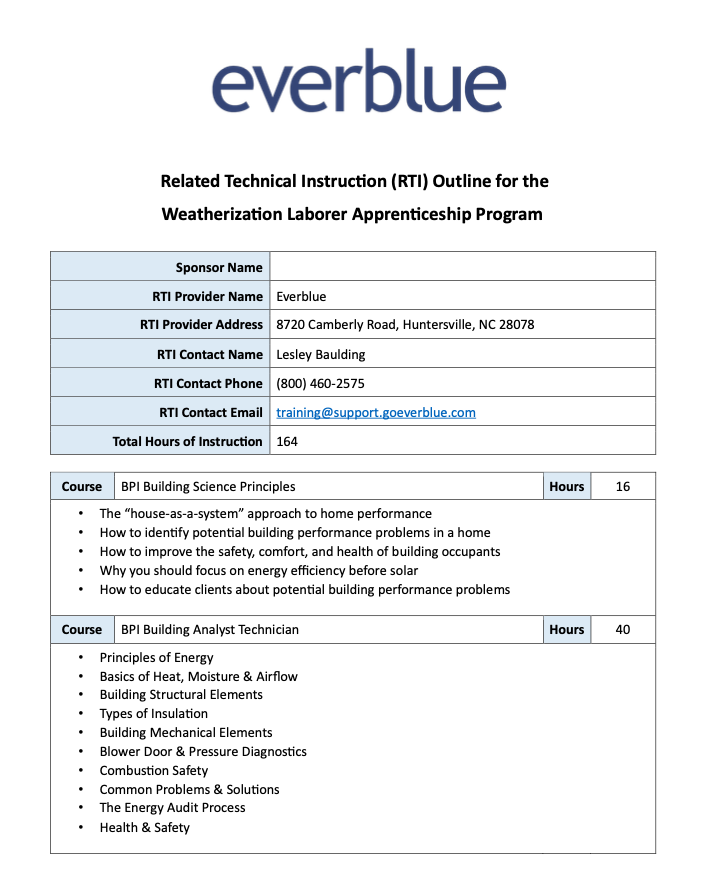

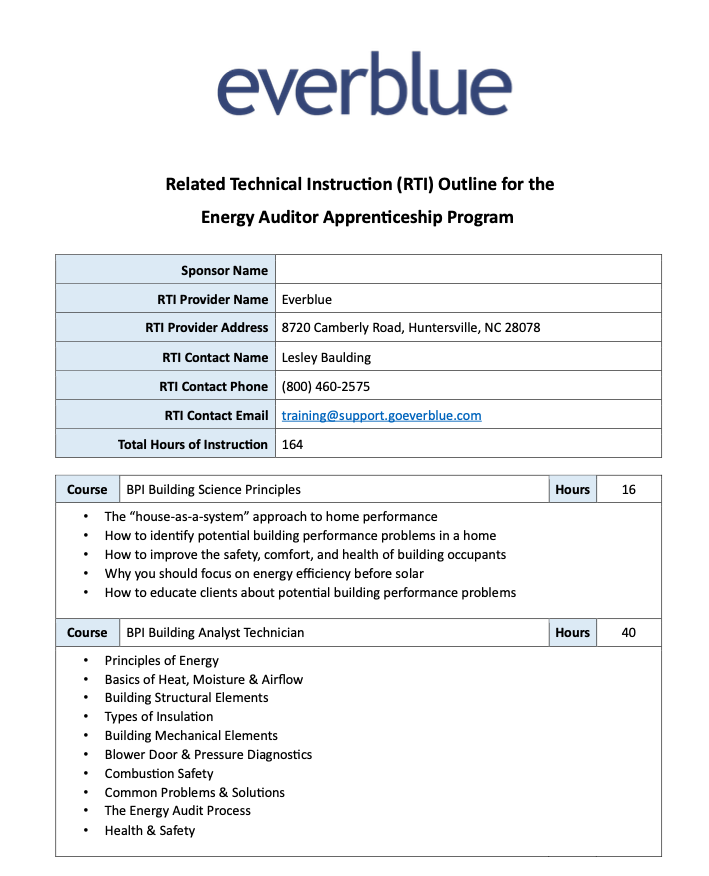

We have the complete set of training to run your Weatherization or Energy Auditor Apprenticeship program.

Participants are required to complete 144 hours of RTI during their apprenticeship program. Everblue provides an end-to-end system for enrolling, training, certifying, and reporting on RTI requirements.

If you're looking to build a Registered Apprenticeship Program to align with the Inflation Reduction Act, know that the funding isn't yet available. However, we're already working with state departments of labor, intermediaries, sponsors, and employers nationwide to lay the groundwork now.

Download the resources below and contact us for more information!

FAQs

Helpful Resources

I'm brand new to all things apprenticeship. Where should I look for information?

The U.S. Department of Labor maintains apprenticeship.gov where you can find information about becoming an apprentice, finding an apprenticeship, advertising your apprenticeship job, partnering with providers of existing apprenticeship programs, and more.

You can also contact your state apprenticeship agency or state Department of Labor office to get more information.

How do I start or participate in an apprenticeship program?

The Interstate Renewable Energy Council (IREC) offers a comprehensive toolkit that details this entire process, but the summary is as follows:

- Identify the Apprenticeable Occupation

- Determine the Program Sponsor

- Choose the Approach and Duration

- Create a Work Process Schedule & Related Instruction Outline (or use Everblue's documents above)

- Develop Program Requirements and Policies

- Register the Program

- Recruit, Hire, and Train Apprentices

- Maintain Reports & Records

I want to be an apprentice. Can you point me in the right direction?

Yes, take a look at our Energy Auditor Apprenticeship program and submit an application to see if you are eligible to join!

Why is there a renewed interest in apprenticeship in the clean energy space?

The Inflation Reduction Act, which was signed into law in August 2022, includes provisions where clean energy tax credit or deduction amounts are substantially increased if certain labor practice requirements are met. For the first time, the federal government is providing the clean energy and energy efficiency sectors with long-term support and a stable business environment by extending these tax credits for a full decade. In the past, Congress let similar tax credits expire after only a few years or renewed them at the last minute, leading to boom-bust cycles. The IRA is a major step forward in ensuring that government spending creates good jobs for workers.

In addition, the weatherization and energy auditing industries have been fairly unregulated for at least the last decade, leading to confusion about what a "weatherization professional" or "energy auditor" is. What knowledge is necessary? What certifications are needed? Apprenticeship helps to standardize these occupations across states, providing a clear pathway for longevity and success.

For more information, see our article on IRA Apprenticeship Requirements.